We’ve all seen youngsters play with a new toy for a week, then abandon it without interest. For next special

Consider a long-lasting gift like a savings bond, CD, or stock for occasions or holidays. Investing gifts may not excite young children or teens, but there are ways to make them interested and teach them financial lessons. When kids grasp the notion of investing, their interest will soar. Consider the following investing gift choices.

Contents

Certificate of Deposits/savings accounts:

Thank you for reading this post, don't forget to subscribe!

CDs and savings accounts are similar, except CDs have a fixed interest rate and are maintained until maturity when investors can withdraw the collected interest. During my time as a math instructor, students were fascinated by the concept of earning interest.

For instance, a $1,000 investment earning 5% annually would become $1,050. They were pleased to earn interest on their interest and calculated that compound interest would make them affluent. Our class created a chart comparing CDs and savings accounts.

Big savers preferred higher CD interest rates, indicating they could delay withdrawals to maximize profits. Both options are suitable for young investors aged 8 and above.

Savings Bonds:

Consider giving the kid-friendly gift of savings bonds from the U.S. Treasury. EE Series bonds can be bought at half their value and could be worth their face value in the future. Even younger children can calculate the maturity date of their bonds.

Series I bonds are bought at face value and adjusted to inflation. They can be redeemed without penalty after five years. If the child redeems bonds for school tuition, the interest received is not taxed. Bonds are a suitable investment for those over 10 years old.

529 Savings Plan:

A 529 Savings Plan is an effective approach to constructing a college fund for your child. This account invests in mutual funds and grows tax-deferred, with tax-free schooling expenditures.

Most state 529 plans are low-maintenance, requiring enrollment and contributions or bank account deductions. You can start 529 accounts at birth and enroll your child later. Have your youngster track and color in their gift donations and education dollars as soon as possible.

Stocks:

When is your child ready for exposure to stocks? Individuals may become aware that their favorite cuisine, apparel, or video game is manufactured for profit. Inform him that corporations issue shares to fund new products, technology, or expansion.

Inform him that he can become a stockholder, owning shares or pieces of a corporation. What things, electronics, or restaurants interest him? Which stores sell good stuff?

His replies provide an excellent foundation for stock selection. Use quote.com or finance.yahoo.com with your child to research stock prices and their rise or drop over the past year. Smartstocks.com is a free game for youngsters to build a million-dollar portfolio in their preferred stocks and track their progress. Background information about firms and stock graphs aid decision-making. Consider which stocks make the best investment gifts.

Add a fun touch to the gift by including relevant items like a Disney toy or McDonald’s gift certificate. Consider giving shares to children aged 12 and older. Stocks can be acquired for a custodial investment account for individuals under 18.

Investment gifting initiates learning. Children can learn to track their investment development. As kids get a basic understanding of investing, they may explore more items to expand their portfolios. They may focus on daily news and the economy.

If a decline causes discouragement, examine possible causes, such as weather-related crop damage or negative press about specific products. Inform them that investing is a long-term strategy for wealth creation, not a quick fix.

Cash:

Young gift recipients might still learn about investment. Consider giving youngsters under 5 a piggy bank to store loose change. As each coin is added, the parent can add one, introducing the notion of expanding money.

The next gift may be cash for the piggy bank. Encourage your youngster to save money in a CD or savings account as they mature and comprehend better. Consider assisting the child in creating a chart highlighting the benefits of each option over keeping money in the piggy bank.

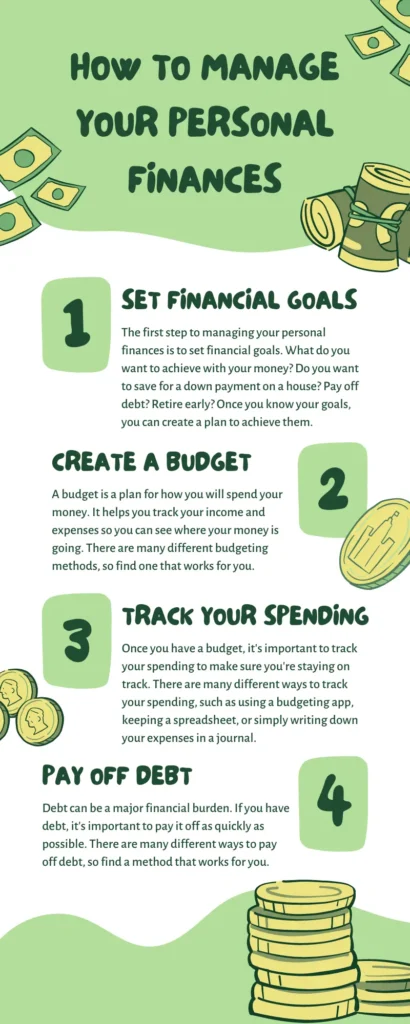

Financial gurus suggest that early investment in children leads to more financial savvy as adults. This investment building will aid in planning for financial goals like education, first automobile, or home. The financial information gained is invaluable.

A good comment from someone like you will boost your confidence to start personal budget management.

Leave a remark and inspire others 🙂