Learn how Nissan Auto Insurance works, how much it might cost, and what kinds of coverage to take into account. Your Nissan deserves the proper protection as a well-liked brand in the United States recognized for both its speed and environmental advancements.

Contents

What is the cost of Nissan Auto Insurance?

Nissan probably has the vehicle you’re looking for, whether you need a sports SUV, a family-friendly minivan, or a regular sedan.

Thank you for reading this post, don't forget to subscribe!

The average annual insurance cost for a Japanese car is $1,950 ($162 per month). The cost of different models of Nissan Auto Insurance varies greatly, with the GT-R being one of the most costly new vehicles to cover and the Altima and Murano being less expensive than average.

Plymouth Rock Insurance is usually your best pick if you’re looking for affordable Nissan Auto Insurance. On well-known models like the Rogue, Titan, and Versa, the corporation provides rates that are less than $700 a year.

Additionally, GEICO provides affordable premiums for the NV Passenger and NV200.

Your Auto Insurance costs will also be influenced by your age, and younger drivers should anticipate paying more for Nissan insurance.

Even if the younger driver has a perfect record, an 18-year-old will pay more than three times as much as a 30-year-old.

The price of your Nissan Auto Insurance will vary depending on your model, how you want to use it, location, driving history, age, and more.

The Nissan Versa, one of the least expensive vehicles on the market in 2023 (per U.S. News and World Report), may be quite inexpensive to insure, especially in light of its safety features.

After all, vehicles with higher safety ratings may be involved in fewer collisions and be eligible for more auto insurance discounts.

PRO TIP:

Depending on the coverages you have, the features of your car may affect your rate differently. For instance, if you have comprehensive and collision coverage, which both cover damages to your automobile, the value of your car may have a greater impact on your cost.

What type of Auto Insurance is required for your Nissan?

Regardless of the kind of vehicle you drive, each state has a minimum needed amount for auto insurance. You’ll likely require at least liability insurance, depending on your state. Additionally, you might need to obtain:

- Coverage for uninsured and underinsured drivers

- Coverage for personal injuries or medical expenses.

Consider purchasing optional comprehensive and collision insurance to protect your Nissan in the case of an accident or other unforeseeable circumstances.

If you have a loan or lease on the vehicle, the lender will usually insist that you have these coverages.

Quick Facts about Nissan Cars

- The Datsun Type 15 was the first mass-produced module, and Nissan was the first manufacturer of Japanese automobiles in large quantities.

- Nissan, a well-known innovator in the field of electric vehicles, won its first environmental honour in 1991. Nissan received the EPA’s “Best of the Best” award in 1997.

- The Fast & Furious movie series and the Gran Turismo racing video game both include Nissan’s GT-R supercar, which has broken speed and acceleration records worldwide.

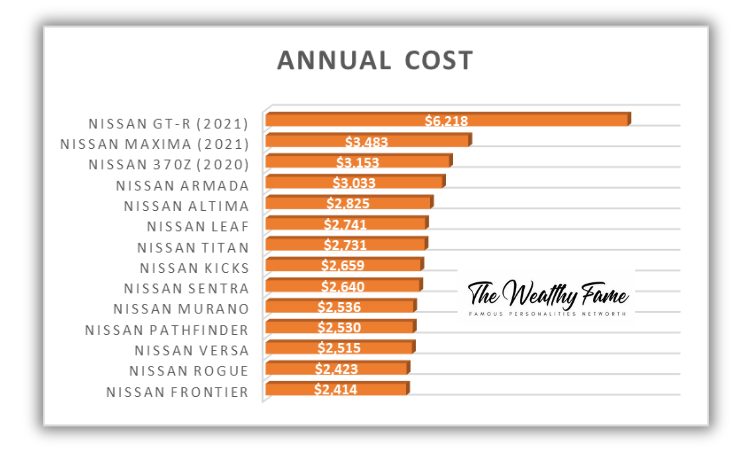

Nissan Auto Insurance Costs by Model

The least expensive Nissans to insure are the Frontier truck, Rogue SUV, and Versa subcompact sedan. The most expensive vehicles are the 370Z sports car, the GT-R sports car, and the Maxima luxury sedan.

Your Auto Insurance costs will also be influenced by your age, and younger drivers should anticipate paying more for Nissan Auto Insurance.

Even if the younger driver has a perfect record, an 18-year-old will pay more than three times as much as a 30-year-old.

The cheapest Nissan car to insure is the Frontier, the company’s least expensive pickup truck, at $2,414 per year for a 2022 model. The GT-R, on the other hand, has an average price of $6,218 for a 2021 model.

| Model | Annual cost |

|---|---|

| Nissan Frontier | $2,414 |

| Nissan Rogue | $2,423 |

| Nissan Versa | $2,515 |

| Nissan Pathfinder | $2,530 |

| Nissan Murano | $2,536 |

| Nissan Sentra | $2,640 |

| Nissan Kicks | $2,659 |

| Nissan Titan | $2,731 |

| Nissan Leaf | $2,741 |

| Nissan Altima | $2,825 |

| Nissan Armada | $3,033 |

| Nissan 370Z (2020) | $3,153 |

| Nissan Maxima (2021) | $3,483 |

| Nissan GT-R (2021) | $6,218 |

NISSAN FRONTIER

Of Nissan’s two pickup truck models, the Frontier is the less expensive to insure. The Auto Insurance coverage cost for the larger, more expensive Titan is around 13% higher, and its MSRP is about $10,000 more.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,414 | $8,201 |

| 2021 | $2,308 | $7,862 |

| 2020 | $2,240 | $7,638 |

| 2019 | $2,093 | $7,146 |

| 2018 | $1,971 | $6,717 |

| 2017 | $1,955 | $6,695 |

| 2016 | $1,872 | $6,432 |

| 2015 | $1,843 | $6,326 |

| 2014 | $1,761 | $5,983 |

| 2013 | $1,693 | $5,727 |

| 2012 | $1,659 | $5,591 |

| 2011 | $1,664 | $5,724 |

Nissan Rogue

The monthly cost of insurance for a new Nissan Rogue is $202. Choose an older model of the Rogue if you want to save money on Auto Insurance; a 2011 Rogue will have 29% lower monthly premiums than a 2022 model.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,423 | $8,238 |

| 2021 | $2,372 | $8,011 |

| 2020 | $2,317 | $7,785 |

| 2019 | $2,280 | $7,679 |

| 2018 | $2,246 | $7,666 |

| 2017 | $2,146 | $7,344 |

| 2016 | $2,077 | $7,158 |

| 2014 | $1,896 | $6,461 |

| 2013 | $1,804 | $6,098 |

| 2012 | $1,809 | $6,130 |

| 2011 | $1,727 | $5,742 |

Nissan Versa

Nissan’s Versa is its smallest and least expensive model, so those trying to save money on a car and insurance might want to give it some thought.

Unfortunately, teens and young drivers considering a Versa will probably have to spend more. The typical cost of insurance for a Versa for a driver under the age of 18 is $8,683, which is more than three times the cost.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,515 | $8,683 |

| 2021 | $2,460 | $8,476 |

| 2020 | $2,307 | $7,929 |

| 2019 | $2,226 | $7,696 |

| 2018 | $2,233 | $7,855 |

| 2017 | $2,135 | $7,529 |

| 2016 | $2,052 | $7,208 |

| 2015 | $1,991 | $6,951 |

| 2014 | $1,890 | $6,584 |

| 2013 | $1,824 | $6,331 |

| 2012 | $1,755 | $6,099 |

| 2011 | $1,802 | $6,248 |

Nissan Pathfinder

Comparing the Pathfinder to its slightly smaller sibling, the Murano, insurance costs are comparable. However, those seeking lower Pathfinder Auto Insurance premiums would choose to consider an earlier model.

Comparing a 2022 model with the same level of coverage to a 2011 Pathfinder will result in $820 annual savings on Auto Insurance.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,530 | $8,484 |

| 2021 | $2,462 | $8,241 |

| 2020 | $2,394 | $7,981 |

| 2019 | $2,324 | $7,772 |

| 2018 | $2,228 | $7,588 |

| 2017 | $2,187 | $7,461 |

| 2016 | $2,073 | $7,040 |

| 2015 | $2,032 | $6,880 |

| 2014 | $1,931 | $6,521 |

| 2013 | $1,868 | $6,256 |

| 2012 | $1,736 | $5,780 |

| 2011 | $1,709 | $5,699 |

Nissan Murano

Compared to a typical Nissan, a Murano is less expensive to insure. Its prices are nearly identical to those of Nissan’s next-largest sport utility vehicle, the Pathfinder.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,536 | $8,531 |

| 2021 | $2,449 | $8,241 |

| 2020 | $2,386 | $8,006 |

| 2019 | $2,357 | $7,948 |

| 2018 | $2,167 | $7,205 |

| 2017 | $2,142 | $7,146 |

| 2016 | $2,049 | $6,878 |

| 2015 | $1,972 | $6,566 |

| 2014 | $1,907 | $6,401 |

| 2013 | $1,836 | $6,103 |

| 2012 | $1,790 | $5,968 |

| 2011 | $1,745 | $5,761 |

Nissan Sentra

The Sentra is the second-cheapest Nissan sedan in terms of Auto Insurance costs; it is more expensive to insure than the Versa and is less expensive than the larger Altima and Maxima.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,640 | $9,208 |

| 2021 | $2,551 | $8,877 |

| 2020 | $2,431 | $8,425 |

| 2019 | $2,380 | $8,254 |

| 2018 | $2,336 | $8,239 |

| 2017 | $2,308 | $8,219 |

| 2016 | $2,226 | $7,912 |

| 2015 | $2,112 | $7,378 |

| 2014 | $2,026 | $7,109 |

| 2013 | $1,996 | $7,002 |

| 2012 | $1,921 | $6,725 |

| 2011 | $1,899 | $6,611 |

Nissan Kicks

The vehicle was just released beginning with the 2018 model year, and its insurance costs are a little more than those of a typical Nissan SUV. Even so, it is still considerably less expensive than cars with greater horsepower, like the Nissan 370Z.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,659 | $9,236 |

| 2021 | $2,557 | $8,851 |

| 2020 | $2,504 | $8,652 |

| 2019 | $2,420 | $8,399 |

| 2018 | $2,221 | $7,684 |

Nissan Titan

Compared to Nissan’s other pickup, the Frontier, coverage for the Titan costs $317 more annually. A Titan will cost you somewhat more to insure than the average Nissan.

Younger drivers will probably pay much more for a Titan’s insurance, as they do for most models. An 18-year-old will typically spend $9,186 per year for Auto Insurance, more than three times what a 30-year-old would.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,731 | $9,186 |

| 2021 | $2,614 | $8,721 |

| 2020 | $2,589 | $8,692 |

| 2019 | $2,486 | $8,296 |

| 2018 | $2,406 | $8,062 |

| 2017 | $2,373 | $7,951 |

| 2015 | $2,193 | $7,474 |

| 2014 | $2,063 | $7,049 |

| 2013 | $2,038 | $6,940 |

| 2012 | $1,971 | $6,675 |

| 2011 | $1,962 | $6,656 |

Nissan Leaf

The Leaf is the most expensive of Nissan’s compact electric vehicle options and the company’s only all-electric vehicle. It is also more expensive than most other Nissans.

Because they are more expensive to repair, electric automobiles can cost more to insure than cars with conventional engines. The fuel savings that come from driving an electric vehicle may be somewhat offset by this.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,741 | $9,811 |

| 2021 | $2,715 | $9,717 |

| 2020 | $2,593 | $9,256 |

| 2019 | $2,484 | $8,811 |

| 2018 | $2,482 | $8,954 |

| 2017 | $2,437 | $8,683 |

| 2016 | $2,250 | $8,023 |

| 2015 | $2,145 | $7,585 |

| 2014 | $2,075 | $7,283 |

| 2013 | $1,983 | $6,929 |

Nissan Altima

The mid-range Nissan car has a somewhat higher insurance cost than the standard Nissan. However, you can pay less if you drive an older Altima.

For our fictitious driver, insurance for a 2011 Altima costs just $1,868 a year, which is 34% less than protection for a 2022 model.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,825 | $9,616 |

| 2021 | $2,721 | $9,235 |

| 2020 | $2,610 | $8,867 |

| 2019 | $2,593 | $8,825 |

| 2018 | $2,572 | $8,850 |

| 2017 | $2,429 | $8,374 |

| 2016 | $2,348 | $8,080 |

| 2015 | $2,217 | $7,567 |

| 2014 | $2,139 | $7,295 |

| 2013 | $1,992 | $6,719 |

| 2012 | $1,873 | $6,363 |

| 2011 | $1,868 | $6,335 |

Nissan Armada

One of Nissan’s most expensive models, the Armada is also its largest SUV. The car is one of the most costly Nissans to insure due to its high price and enormous size: Only four Nissan vehicles currently on the market have higher insurance costs.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $3,033 | $9,988 |

| 2021 | $2,890 | $9,497 |

| 2020 | $2,754 | $9,068 |

| 2019 | $2,694 | $8,895 |

| 2018 | $2,465 | $8,095 |

| 2017 | $2,416 | $7,979 |

| 2015 | $2,151 | $7,138 |

| 2014 | $2,077 | $6,963 |

| 2013 | $2,073 | $6,855 |

| 2012 | $1,978 | $6,569 |

| 2011 | $1,939 | $6,384 |

Nissan 370Z (2020)

For this car’s insurance, a 30-year-old will pay significantly less than an 18-year-old will: The average cost of Auto Insurance for a young driver under the age of 18 with a clean driving record is $10,536, which is more than three times the cost of insurance for the older motorist.

The 350Z was retired by Nissan in 2009, and the 370Z is the successor model.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2020 | $3,153 | $10,536 |

| 2019 | $3,070 | $10,667 |

| 2018 | $3,011 | $10,504 |

| 2017 | $2,846 | $10,028 |

| 2016 | $2,760 | $9,719 |

| 2015 | $2,572 | $8,990 |

| 2014 | $2,416 | $8,381 |

| 2013 | $2,450 | $8,484 |

| 2012 | $2,314 | $7,969 |

| 2011 | $2,242 | $7,687 |

Nissan Maxima (2021)

The Maxima is the Nissan sedan whose insurance costs are the highest. However, it can be far less expensive to insure some older Maximas: Insurance for a 2011 Maxima costs $2,211 annually, which is $1,272 more than insurance for a 2021 Maxima.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2021 | $3,483 | $11,978 |

| 2019 | $3,169 | $10,812 |

| 2018 | $3,102 | $10,589 |

| 2017 | $2,751 | $9,436 |

| 2016 | $2,717 | $9,271 |

| 2014 | $2,437 | $8,262 |

| 2013 | $2,431 | $8,219 |

| 2012 | $2,303 | $7,763 |

| 2011 | $2,211 | $7,422 |

Nissan GT-R (2021)

Nissan’s fastest and most costly vehicle, the GT-R also has the highest Auto Insurance rates. In comparison to Nissan’s other, less expensive sports vehicle, the 370Z, you should anticipate paying roughly 84% more for insurance on a GT-R.

Auto Insurance for a 2021 GT-R will cost significantly more for young drivers. A GT-R will cost $21,005 a year to insure for a driver under the age of 18. That is more than three times what someone in their 30s will shell out.

| Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2021 | $6,218 | $21,005 |

| 2020 | $5,792 | $19,169 |

| 2019 | $5,276 | $17,344 |

| 2018 | $5,493 | $18,442 |

| 2017 | $5,261 | $17,639 |

| 2016 | $4,878 | $16,449 |

| 2015 | $4,708 | $15,724 |

| 2014 | $4,426 | $14,684 |

| 2013 | $3,991 | $12,950 |

| 2012 | $3,702 | $12,305 |

| 2011 | $3,521 | $11,796 |

Why do Nissan Auto Insurance prices vary by Model?

The Nissan Frontier has the lowest auto insurance prices due to its low value and affordable repair expenses, which allow insurers to offer lower premiums.

Because of its high MSRP of $115,335 and higher propensity for dangerous driving, the Nissan GT-R is the most expensive to insure.

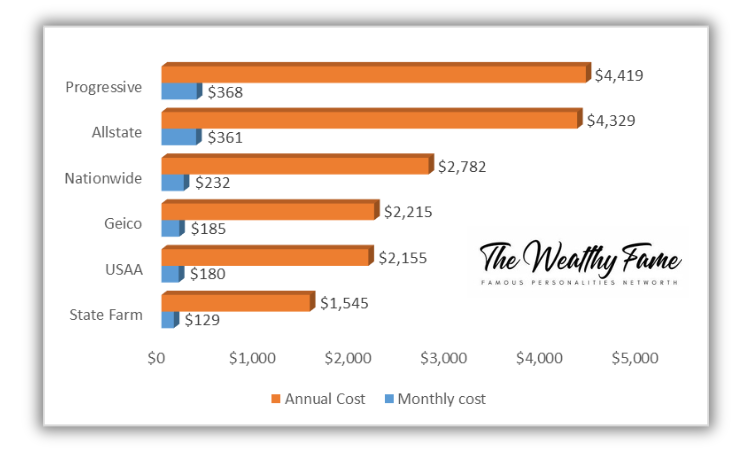

Nissan Auto Insurance by Company

Nissan owners can get the most affordable auto insurance from State Farm for a 2021 model at $1,545 a year for full coverage.

That’s 65% less than the most expensive insurer, Progressive ($4,419), and 47% less than the average premium we discovered across the board ($2,908).

| Company | Monthly cost | Annual Cost |

|---|---|---|

| State Farm | $129 | $1,545 |

| USAA | $180 | $2,155 |

| Geico | $185 | $2,215 |

| Nationwide | $232 | $2,782 |

| Allstate | $361 | $4,329 |

| Progressive | $368 | $4,419 |

How to get a Nissan auto insurance quote

Customer Statistics

Top 5 Auto Insurance Companies:

| Insurance Companies | Coverage Percentage |

| Geico | 10% |

| Progressive | 8% |

| State Farm | 8% |

| Allstate | 6% |

| Nationwide | 2% |

Male vs. Female

| Male percentage | Male percentage | Average Age |

| 47 | 53 | 48 |

Important Factors:

| Price | 53% |

| Coverage options | 30% |

| Customer Service | 14% |

| Just care about Auto Insurance | 4% |

Strategies

Six significant national auto insurance companies were assessed for their rates: Allstate, Geico, Nationwide, Progressive, State Farm, and USAA.

In Texas, we employed two example drivers, one who was 18 and the other who was 30. The drivers’ profiles were otherwise the same: both were male, had 16-year-old licenses, and had no recent tickets or accidents that they were at fault.

Data on auto insurance rates were sourced from Quadrant Information Services for ValuePenguin’s report.

These rates should only be used as a comparison because your own quotations might differ. They were obtained publically from insurer filings.

Rising Auto Insurance Costs Due to High Theft Rates

The fact that some Nissan models are well-liked by thieves is one of the main factors that raise the cost of insurance a little.

Models like the Altima and the Maxima are stolen fairly frequently, according to the National Insurance Crime Bureau’s state-by-state top-ten lists.

It appears that 1990s models are the main targets of thieves. This auto manufacturer’s automobiles are slightly more expensive to insure since these figures make insurers uneasy.

Good Safety Ratings Support maintaining lower Auto insurance costs

On the plus side, these cars typically have respectable safety ratings. The Nissan Altima received the highest grade of “Good” in all crash test categories from the Insurance Institute for Highway Safety, or IIHS, with the exception of roof strength, where it received the second-best rating of “Acceptable.”

The Quest and the Xterra received identical ratings, demonstrating their general safety despite potential minor roof strength problems. The price of insuring them would be significantly higher if they didn’t have such high safety ratings.

The automakers’ automobiles aren’t exactly cheap, but they’re also not outrageously pricey either. For instance, the Quest minivan has a starting MSRP of slightly under $26,000.

The base price of the Xterra SUV is close to $25,000. The starting MSRP of the enduringly well-liked Altima sedan is slightly over $20,000. These affordable costs aid in containing the cost of Nissan Auto Insurance.

Following are the typical annual Nissan Auto Insurance costs for several Nissan vehicles:

Altima sedan 4-cylinder: $1,330.00

Xterra 6-Cylinder SUV: $1,190.00

Quest 6-cylinder minivan: $1,354.00

Please share this article with your friends and leave a comment with your feedback. Don’t forget to rate the article by clicking on the star rating ⭐⭐⭐⭐⭐ at the top! Your rating helps us understand what content our readers find most valuable and helps us improve our future articles. Thank you for your support!

[…] Also, read Nissan Auto Insurance: What You Need to Know Before You Buy. […]